Navigating the technology marketplace can be a big challenge – especially in cybersecurity. With so much marketechture, FUD and other confusion, it’s difficult to distinguish between tools that will genuinely secure and enable from those that will be ineffective or obtrusive to productivity. One firm attempting to make this journey a more informed and insightful one is KuppingerCole. The German analyst company has become Europe’s leading research firm for all topics around identity management and digital identities.

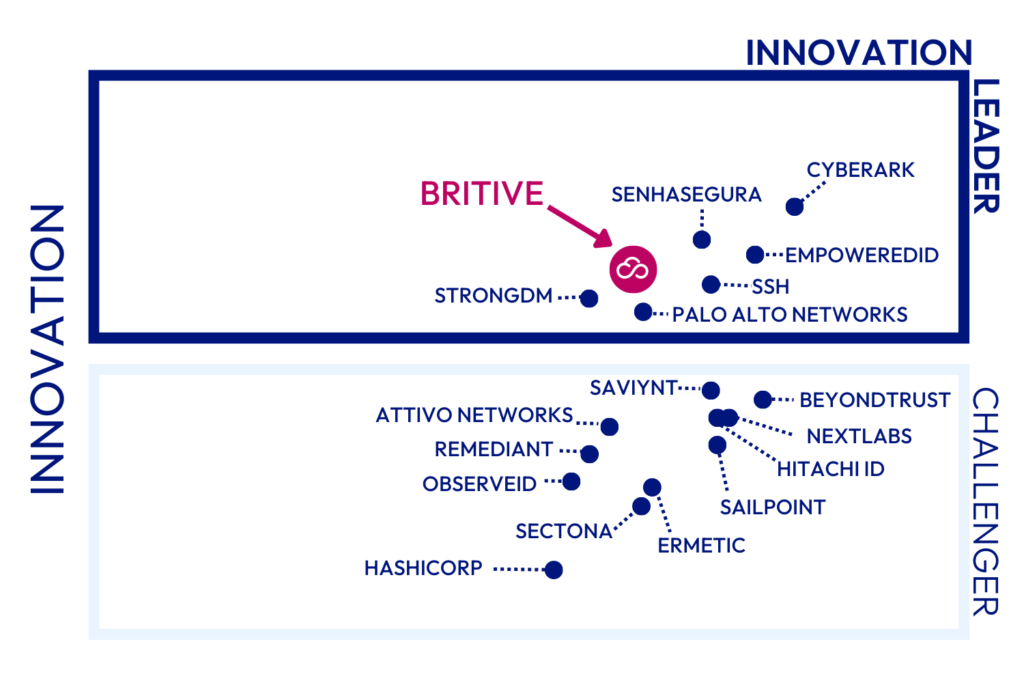

A few weeks ago KuppingerCole published its Leadership Compass for CIEM & Dynamic Resource Entitlement & Access Management (DREAM) platforms, designed to help security leaders determine the relative strengths of different vendors in the wider identity space.

Its author Paul Fisher points to the cloud as a reason that the landscape has moved so quickly and helps explain why identity management has become so distributed and complex. Access to resource in the cloud is managed by engineering and DevOps teams who do not have the same priorities or skillsets as IAM leaders. “There is a fork in the road emerging – one way is to persevere with the top down (PAM) method of controlling access centrally – or by opening up identity and security to individual departments within organizations.”

Determining which tools are the best fit for organizations seeking to better manage in identities (both human and machine) in the cloud is something that the Leadership Compass is designed specifically to aid. Unlike the Gartner Magic Quadrant, Forrester Wave or IDC MarketScape, the Leadership Compass breaks the ranking into three broad categories – market, product, and innovation. These groupings allow readers to glean a more nuanced analysis of the representative vendors

Market Leadership

The Market subcategory reflects a vendor’s reach. That includes factors such as legacy position in the industry, the volume of customers and revenue, the geographic distribution profile of the business, the size of client deployments, the number of employees, the scale of the partner ecosystem and a variety of financial metrics. These are hard datapoints that cannot be objectively disputed and allow potential buyers of DREAM solutions to isolate vendors that might meet their needs from a buying perspective. For some organizations, selecting the largest, most stable options is very attractive. As the idiom goes: no one ever got fired for choosing IBM. Advantages in scale and name recognition are criteria that newcomer vendors simply cannot compete with, and for some this will be appealing.

In this grouping, vendors like CyberArk, Nextlabs, Hitachi, Delinea and Palo Alto Networks all emerge as leaders, carrying significantly more weight than relative newcomers.

Splitting the Leadership Compass like this is why these reports are so popular – two axes alone would fail to capture the full flavour of the market.

Innovation Leadership

A closer look at the Innovation subcategory is similarly insightful. For security leaders that operate closer to the cutting-edge, this allows buyers to identify the technologies that are embracing more innovative approaches to identity security.

Innovation is an overused word, so it’s important to describe what is meant by the term. It’s not just about delivering a constant flow of new releases. Rather, innovative companies take a customer-oriented upgrade approach, delivering use case-driven functionality and novel features – while also maintaining compatibility with previous versions.

“Innovation is, from our perspective, a key capability in all IT market segments. Customers require innovation to meet evolving and even emerging business requirements. Innovation is not about delivering a constant flow of new releases. Rather, innovative companies take a customer-oriented upgrade approach, delivering customer requested and other cutting-edge features, while maintaining compatibility with previous versions.”

For companies willing to work with a newer technology, often from a smaller vendor, there can be a vast array of benefits. It typically means adopting a more secure risk posture, as challenger solutions will seek to solve the problems manifested by legacy solutions. The investment from VCs and market momentum of these more innovative companies is centered on their ability to offer a more innovative solution in ways that the better armed large vendors cannot, or will not, meet. Innovative products are more likely to map well to modern environments too; in this instance, the cloud. Cloud-native organizations or companies that have a migration path to working more in the cloud will be those best positioned to benefit from innovative access management and privileged entitlement solutions, as they are typically encountering the emerging issues of cloud security most acutely.

Only three vendors meet KuppingerCole’s criteria for leadership in the Innovation category. Britive is featured alongside EmpowerID and Senhasegura as Innovation Leaders.

An Analysis of Britive

A closer look at Britive, an Innovation Leader, is also available in the report. Again, this helps point security leaders towards solutions that will most closely meet their requirements.

- SECURITY – positive

- FUNCTIONALITY – positive

- DEPLOYMENT – neutral

- INTEROPERABILITY – positive

- USABILITY – strong positive

- INNOVATIVENESS – positive

- MARKET POSITION – neutral

- FINANCIAL STRENGTH – positive

- ECOSYSTEM – positive

To discover more about what KuppingerCole published on the DREAM market and Britive in particular, you can get free access to the entire report here.